Semiconductor stocks are some of the most sought after stocks this year.

Xilinx (XLNX) soared from a 2016 low of $40 to $60 a share, even though its earnings went overlooked for months. Intel (INTC) jumped from year low of $27 to $38.

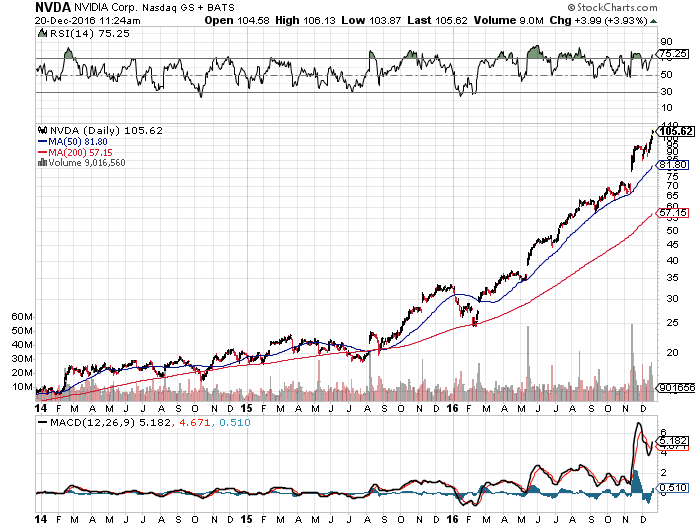

But the biggest standout among semiconductor stocks has been NVIDIA (NVDA), which just hit an all-time high of $105 this week.

The stock – which priced at just $19 in 2014 – is now up 453% in two years.

Since Donald Trump was elected, the stock is up nearly 50% more.

It’s up even more this week after Goldman Sachs upgraded their price targets. The bank sees 27% upside in the stock with a $129 price target, noting:

“We continue to view NVDA as a unique growth story in semis, levered to positive secular trends in gaming, VR (virtual reality), AI (artificial intelligence)/ML (machine learning) and automotive. Note our revised FY18/19 EPS estimates are 26%/57% above the Street, respectively, and we expect estimate revisions to serve as a positive catalyst for the stock in the coming quarters.”

“We remain confident in the growth trajectory of Nvidia’s data center business, with our revenue estimates moving up 35%/53% for FY18/19 and we now expect data center segment revenue to grow 99%/53% in FY18/19 vs 50%/34% prior. We are also taking a more positive long-term view on the overall gaming market, as we expect growth of the gaming population and product refresh to drive revenue in addition to VR. As a result, we now model overall Gaming segment revenue +20%/+28% yoy in FY18/19 vs +16%/+20% prior.”

Clearly, Goldman is expecting for NVDA to grow by leaps and bounds here.

The Shocking Truth About Virtual Reality

It’s the hottest topic in technology today. And one of the most anticipated devices is slated to hit the market in just a few weeks. Within 3 years, an expected 80.2 million Americans will own, or have access to a Virtual Reality device. But almost no truly understand how it could affect our lives.. Here’s what you need to know…

Every $10,000 risked then is worth $55,300.

Not bad for a company left for dead not too long ago.

To many, they believe they missed the run. It’s all just downhill from here.

But that’s not the case at all.

With its processors helping to power Google searches, the Amazon Alexa digital assistant, and Tesla’s self-driving cars, as well as powering artificial intelligence, and the power to power the next wave of computing, times are exciting for the company.

Better yet, with further industry consolidation, and Internet of Things opportunities straight ahead, the upside appears to be unlimited.

Plus, when quarterly revenues soar 54% year over year, and as its gaming revenues soar 63%, there’s not a lot of reasons to sell. At least, not yet… At $105 a share, given impressive return on equity and earnings growth and potential, shares still don’t look outrageously overvalued, especially as its virtual reality business takes off.

While NVDA may have struggled in recent years, it’s near-monopoly on promising technology – like virtual reality – gives it a bright future.