It became tough to feel bad for oil bulls.

In early 2017, they had every opportunity to see the writing on the wall. Yet, they chose to ignore the warning signs. They failed to understand that there was still far too much supply on market, and not a significant amount of demand.

Traders thought we’d see $60 mid-2017.

Algerian Energy Minister Noureddine Bouttarfa once noted that oil prices could move above $55 on the idea that a supply glut could be gone by year-end. Even Russia and Saudi Arabia argued for a near-term rebalancing.

Even with extensions from OPEC, a rebalance was still unlikely.

A revolutionary fuel source is poised to decimate Big Oil’s obscene profits, make OPEC obsolete, and hand the United States 100% energy independence for the first time in 40 years.

In fact, while that extension would continue to remove 1.8 million barrels a day from the market through March 2018, it wouldn’t be enough, as production picked up steam in other parts of the world.

Since the middle of 2016, U.S. oil production has jumped about 10% to 9.3 million barrels per day (bpd). Worse, in the months ahead, the U.S. was expected to add another 950,000 barrels per day (bpd), overshadowing OPEC cuts even more.

There’s also worry that we could see rising inventories from other non-OPEC countries like Nigeria and Libya. In fact, Libyan output was expected to rise above 800,000 bpd for the first time since 2014. Nigeria was expected to return to 2.2 million barrels this year, and potentially 2.5 million bpd by 2019.

Worse, according to the IEA, supply was likely to outpace consumption in 2018, too. “In 2018,” they noted, per Reuters, “we expect non-OPEC production to grow 1.5 million bpd, which is slightly more than the expected increase in global demand.”

U.S. shale output was expected to add a great deal of that supply.

Some analysts believe that by 2018, prices could easily fall to $30 to $35. While the current OPEC agreement calls for a reduction of 1.8 million bpd, as of June 2017, analysts believe another 700,000 bpd needs to be cut immediately with further cuts next year. Or, they say $30 is a real possibility.

Interesting to note, these fears haven’t change in quite some time. Traders knew that surging U.S. oil output could damage any OPEC reduction.

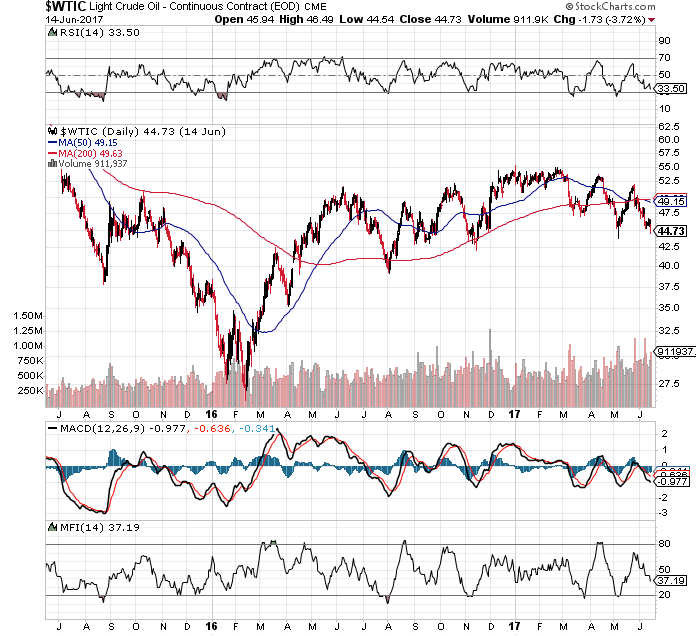

Technically, the writing has been on the wall for some time, too. Look at what happened multiple times since late 2016. Each time oil has flirted with $55 a barrel, it fails at that resistance point, highlighted by overvalued RSI, MACD and Money Flow. Yet, traders ignored that, too.

Speaking of oil prices, a new fuel source is emerging as a serious threat to Big Oil. Get the full report here.